Mar 10, 2016 - 12:15pm

U.S. Chamber of Commerce

Cadillac Tax Delay Is a Down Payment on Its Repeal

Sean Hackbarth

Senior Editor, Digital Content

Employees and employers earned a win in late 2015 when Congress passed and President Barack Obama signed legislation that delayed the Cadillac Tax-- the Affordable Care Actfs 40% excise tax on high-value health plans--for two years.

Yet, repeal advocates are working as if nothing changed.

Wasnft the delay a win? Why the urgency to continue fighting?

While the delay is welcome, only the taxfs repeal can fix problems that are already affecting companies and their employees.

gThe answer is that employers wisely plan for the long term and phase-in changes; especially when they result in workers bearing a greater share of the cost burden,h John Tiberi and James Klein explained in an op-ed in The Hill:

While Congress provided a brief reprieve, companies are making changes today to avoid (or delay) being on a trajectory to trigger the tax. A Mercer survey of 700 employers found that anticipation of the 40 percent tax is already leading many employers to consider imposing a surcharge for covering employees' spouses or exclude them from coverage altogether. Whatfs needed now is full repeal.

Despite the Delay Employers are Making Health Benefits Changes

Prior to the two-year delay, the New York Federal Reserve Bank

researchers noted that employers were making big changes to the health

benefits they offer workers [emphasis mine]:

In the Kaiser Family Foundation survey, 8 percent of all firms offering health benefits reported switching to a lower cost plan in anticipation of the tax. The plan changes they made included increasing cost sharing, reducing the scope of covered services, and increasing incentives to use less costly providers.

Similar trends emerged in our August 2015 surveys. Among the firms responding to our surveys, 64 percent of Cadillac-yes firms said that they are making modifications to their health plan or switching to a new provider in response to the ACA in general. This compares to 55 percent of Cadillac-no firms. Among firms making changes, some responses from Cadillac-yes and Cadillac-no firms are similar: The vast majority of these firms are retrenching their plans by raising total premiums, deductibles, and out-of-pocket maximums.

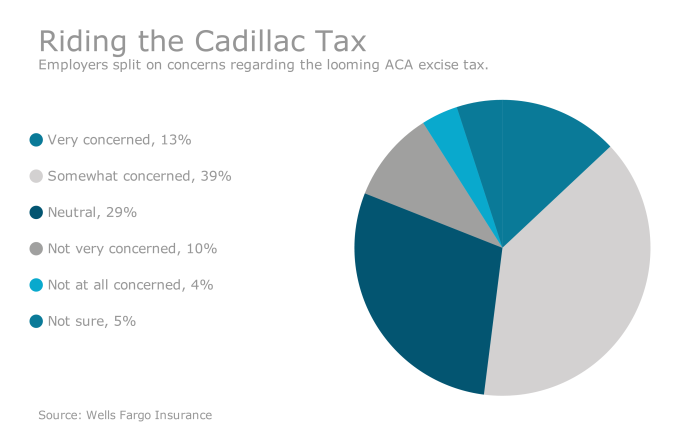

But even with the delay, the excise tax still looms over employers. Employee Benefits News reports that a Wells Fargo Insurance study found:

More than half (58%) of the employers surveyed expect their medical plan costs to exceed the thresholds for the Affordable Care Actfs Cadillac tax, which was originally due to take effect in 2018, but has been delayed until 2020. Additionally, 70% of employers expect their budgets for benefit plans to increase, the report says.

Source: Employee Benefits News

Employees end up getting squeezed with higher costs and reduced health coverage, and many have seen employer contributions to their flexible saving accounts or health savings accounts reduced or eliminated.

A tax intended to contain health care costs in order to help workers ends up hurting them.

Tax Proponents Arenft Letting Up.

Another reason Cadillac Tax repeal advocates canft let up is proponents of the tax continue arguing for it.

Proponents like The Washington Post editorial board want the tax to survive, because they incorrectly think it will contain rising health care costs.

But there are other options than raising taxes on employer-sponsored health plans that hurt their employees. In 2008 the Congressional Budget Office gathered ideas on how to tame health care costs.

"It's a false choice to say that the only way to control costs is to have this 40% excise tax,h Randy Johnson, the U.S. Chamberfs senior vice president for Labor, Immigration and Employee Benefits, insisted to reporters in 2015.

Along with friendly media outlets, the White House is also trying to save the tax. President Barack Obamafs FY 2017 budget contains a minor change in how the tax will be targeted, but it doesnft address the fact that the tax itself is the problem.

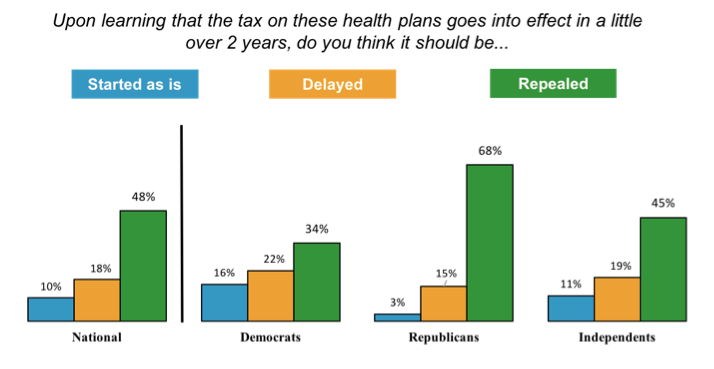

Tax proponents are running against the strong tide of public opinion. A 2015 poll found that nearly half (48%) want the Cadillac Tax repealed.

Source: Morning Consult

A broad swath of support that includes both businesses and unions want the excise tax repealed. They understand that simply delaying it wonft protect the employer-sponsored health plans millions of Americans rely on. Only repeal can do that.